August 22, 2021 - New York Times

This yr, the federal authorities ordered hospitals to start publishing a prized secret: a whole record of the costs they negotiate with non-public insurers.

The insurers’ commerce affiliation had referred to as the rule unconstitutional and stated it might “undermine competitive negotiations.” Four hospital associations collectively sued the federal government to dam it, and appealed when they lost.

They lost again, and 7 months later, many hospitals are merely ignoring the requirement and posting nothing.

But information from the hospitals which have complied hints at why the highly effective industries needed this data to stay hidden.

It reveals hospitals are charging sufferers wildly totally different quantities for a similar primary providers: procedures so simple as an X-ray or a being pregnant check.

And it gives quite a few examples of main well being insurers ・a few of the world’s largest firms, with billions in annual profits ・negotiating surprisingly unfavorable charges for his or her prospects. In many instances, insured sufferers are getting costs which might be larger than they’d in the event that they pretended to don’t have any protection in any respect.

At the University of Mississippi Medical Center, a colonoscopy prices …

$1,463

with a Cigna plan.

$2,144

with an Aetna plan.

$782

with no insurance coverage in any respect.

Until now, shoppers had no solution to know earlier than they acquired the invoice what costs they and their insurers can be paying. Some insurance coverage firms have refused to offer the knowledge when requested by sufferers and the employers that employed the businesses to offer protection.

This secrecy has allowed hospitals to inform sufferers that they’re getting “steep” reductions, whereas nonetheless charging them many instances what a public program like Medicare is prepared to pay.

And it has left insurers with little incentive to barter nicely.

The peculiar economics of medical health insurance additionally assist hold costs excessive.

Customers choose insurance policy primarily based on whether or not their most popular medical doctors and hospitals are coated, making it exhausting for an insurer to stroll away from a foul deal. The insurer additionally could not have a robust motivation to, provided that the extra that’s spent on care, the extra an insurance coverage firm can earn.

Federal laws restrict insurers’ earnings to a share of the quantity they spend on care. And in some plans involving giant employers, insurers are usually not even utilizing their very own cash. The employers pay the medical payments, and provides insurers a reduce of the prices in trade for administering the plan.

A rising variety of sufferers have purpose to care when their insurer negotiates a foul deal. More Americans than ever are enrolled in high-deductible plans that depart them liable for hundreds of {dollars} in prices earlier than protection kicks in.

Patients often struggle to afford these payments. Sixteen p.c of insured households at present have medical debt, with a median amount of $2,000.

Even when staff attain their deductible, they could must pay a share of the associated fee. And in the long term, the excessive costs trickle down within the type of larger premiums, which throughout the nation are rising every year.

At the Hospital of the University of Pennsylvania, a being pregnant check prices …

$18

for Blue Cross sufferers in Pennsylvania.

$58

for Blue Cross HMO sufferers

in New Jersey.

$93

for Blue Cross PPO sufferers

in New Jersey.

$10

with no insurance coverage in any respect.

Insurers and hospitals say that a handful of providers doesn’t present a full image of their negotiations, and that the printed information recordsdata don’t account for necessary points of their contracts, like bonuses for offering high-quality care.

These charge sheets are usually not useful to anybody,” stated Molly Smith, vice chairman for public coverage on the American Hospital Association. “It’s really hard to say that when a lot of hospitals are putting in a lot of effort to comply with the rule, but I would set them aside and avoid them.”

The commerce affiliation for insurers stated it was “an anomaly” that some insured sufferers acquired worse costs than these paying money.

Insurers need to be sure they’re negotiating the most effective offers they’ll for his or her members, to verify their merchandise have aggressive premiums,” stated Matt Eyles, chief govt of America’s Health Insurance Plans.

The 5 largest insurers ・Aetna, Cigna, Humana, United and the Blue Cross Blue Shield Association ・all declined requests for on-the-record interviews. Cigna, Humana and Blue Cross offered statements that stated they help worth transparency.nc

The requirement to publish costs is a uncommon bipartisan effort: a Trump-era initiative that the Biden administration helps. But the info has been troublesome to attract which means from, particularly for shoppers.

The New York Times partnered with two University of Maryland-Baltimore County researchers, Morgan Henderson and Morgane Mouslim, to show the recordsdata right into a database that confirmed how a lot primary medical care prices at 60 main hospitals.

The information doesn’t but present any insurer at all times getting the most effective or worst costs. Small well being plans with seemingly little leverage are generally out-negotiating the 5 insurers that dominate the U.S. market. And a single insurer can have a half-dozen totally different costs inside the identical facility, primarily based on which plan was chosen at open enrollment, and whether or not it was purchased as a person or by work.

But the disclosures already upend the essential math that employers and prospects have been utilizing once they attempt to get a superb deal.

People rigorously weighing two plans ・selecting the next month-to-month value or a bigger deductible ・don’t know that they could even be choosing a a lot worse worth once they later want care.

Even for easy procedures, the distinction could be hundreds of {dollars}, sufficient to erase any potential financial savings.

At Aurora St. Luke’s in Milwaukee, an M.R.I. prices United enrollees …

$1,093

if they’ve United’s HMO plan.

$4,029

if they’ve United’s PPO plan.

It’s not as if employers can share that data at open enrollment: They typically don’t know both.

It’s not simply particular person sufferers who’re in the dead of night,” stated Martin Gaynor, a Carnegie Mellon economist who research well being pricing. “Employers are in the dark. Governments are in the dark. It’s just astonishing how deeply ignorant we are about these prices.”

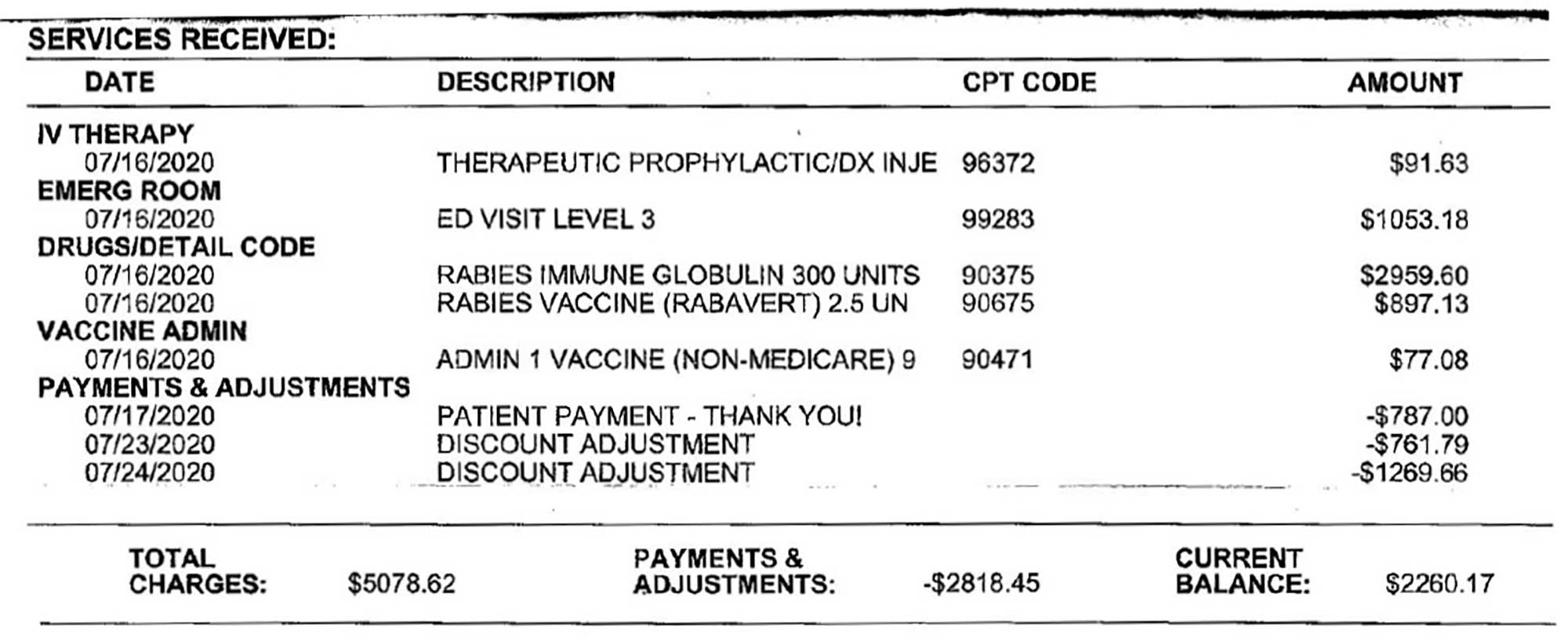

Take the issue Caroline Eichelberger confronted after a stray canine bit her son Nathan at a Utah campsite final July.

Nathan’s pediatrician examined the wound and located it wasn’t critical. But inside per week, Nathan wanted a shot to forestall rabies that was out there solely in emergency rooms.

Ms. Eichelberger took Nathan to Layton Hospital in Layton, Utah, close to her home. It hasn’t printed worth information for an emergency rabies vaccine, however the largest hospital in the identical well being system, Intermountain Medical Center, has.

Nathan, then 7 years previous, obtained a baby’s dose of two medication to forestall rabies. The invoice additionally included two drug administration charges and a cost for utilizing the emergency room.

Intermountain owns a regional insurer referred to as ChooseHealth. It is at present paying the bottom worth for these providers: $1,284.

In the identical emergency room, Regence BlueCross BlueShield pays $3,457.

Ms. Eichelberger’s insurer, Cigna, pays essentially the most: $4,198.

For sufferers who pay money, the cost is $3,704. Half of the insurers at Intermountain are paying charges larger than the “cash price” paid by individuals who both don’t have or aren’t utilizing insurance coverage.

This sample happens at different hospitals, generally with extra drastic penalties for adults, who require the next dosage.

Prices had been nonetheless secret when Brian Daugherty went to an emergency room close to Orlando, Fla., for a rabies shot after a cat chunk final summer time.

I attempted to get some pricing data, however they made it seem to be such a uncommon factor they couldn’t determine for me,” he stated.

He went to IntroductionHealth Orlando as a result of it was near his home. That was an costly resolution: It has the best worth for rabies photographs amongst 24 hospitals that included the service of their newly launched information units.

The worth there for an grownup dose of the drug that forestalls rabies varies from $16,953 to $37,214 ・not together with the emergency-room price that usually goes with it.t

Mr. Daugherty’s complete invoice was $18,357. After his insurer’s contribution, he owed $6,351.

It was a complete shock once I noticed they needed me to pay that a lot,” stated Mr. Daugherty, who finally negotiated the invoice all the way down to $1,692.

In a press release, IntroductionHealth stated it was working to make “consumer charges more consistent and predictable.”

If Mr. Daugherty had pushed two hours to the University of Florida’s flagship hospital, the entire worth ・between him and his insurer ・would have been about half as a lot.

Similar disparities present up throughout all kinds of primary care.

One means to take a look at the prices is to match them with charges paid by Medicare, the federal government program that covers older folks. In normal, Medicare covers 87 percent of the price of care, in line with hospital affiliation estimates.

At a number of hospitals, main well being plans pay greater than 4 instances the Medicare charge for a routine colonoscopy.

And for an M.R.I. scan, some are paying greater than 10 instances what the federal authorities is prepared to pay.

Health economists consider insurers as basically shopping for in bulk, utilizing their giant membership to get higher offers. Some had been startled to see quite a few cases by which insurers pay greater than the money charge.

Whether these money charges can be found to insured sufferers varies from hospital to hospital, and even when they’re, these funds wouldn’t rely towards a affected person’s deductible. But the truth that insurers are paying greater than them raises questions on how nicely they’re negotiating, consultants stated.

The worrying factor is that the third social gathering you’re paying to barter in your behalf isn’t doing in addition to you’ll by yourself,” stated Zack Cooper, an economist at Yale who research well being care pricing.

Employers are the biggest purchasers of medical health insurance and would profit essentially the most from decrease costs. But most choose plans with out figuring out what they and their staff can pay.

To discover out what the costs are, they would want to solicit bids for a brand new plan, which may frustrate staff who don’t need to change suppliers.

It additionally requires the employers to rent attorneys and consultants, at a value of about $50,000, estimated Nathan Cooper, who manages well being advantages for a union chapter that represents Colorado sheet steel and air-conditioning staff.

If you need the costs, you must spend to get them,” he stated.

At hospitals within the Erlanger Health System in Tennessee, administration of a flu vaccine prices …

$104

with a Blue Cross plan.

Employers who do generally come up empty-handed.

Larimer County, in Colorado, covers 3,500 staff and their households in its well being plan. In 2018, county officers requested their insurer to share its negotiated charges. It refused.

We pushed the difficulty all the best way to the C.E.O. degree,” stated Jennifer Whitener, the county’s human assets director. “They said it was confidential.”

Ms. Whitener, who beforehand managed employer insurance coverage contracts for a serious well being insurer, determined to rebid the contract. She put out a request for brand spanking new proposals that included a query about insurers’ charges at native hospitals.

A half dozen insurers positioned bids on the contract. All however one skipped the query totally.

“They don’t need their secrets and techniques on the market,” Ms. Whitener stated. “They want to be able to tout that they’ve got the best deal in town, even if they don’t.”

Hospitals and insurers may also disguise behind the contracts they’ve signed, which frequently prohibit them from revealing their charges.

“We had gag orders in all our contracts,” stated Richard Stephenson, who labored for the Blue Cross Blue Shield Association from 2006 till 2017 and now runs a medical worth transparency start-up, Redu Health. (The affiliation says these clauses have grow to be much less frequent.)

At Memorial Regional Hospital, in Florida, an M.R.I. prices …

$1,827

with a Cigna plan.

$2,148

with a Humana plan.

$2,455

with a Blue Cross plan.

$262

with a Medicare plan.

Mr. Stephenson oversaw a workforce that made positive the gag orders had been being adopted. He stated he thought insurers had been “scared to death” that if the info got here out, offended hospitals or medical doctors would possibly depart their networks.

The Eichelberger household at house. Last summer time Nathan, second from proper, was bitten by a stray canine and wanted a rabies shot. The household initially obtained an estimate that it might value about $800 paying money, however later obtained a shock invoice for over $2,000 extra.Lindsay D’Addato for The New York Times

Ms. Eichelberger’s plan had a $3,500 deductible, so she labored exhausting to seek out the most effective worth for her son’s care.

But neither the hospitals she referred to as nor her insurer would give her solutions.

She made her resolution primarily based on the little data she may get: a hospital, Layton, that stated it might cost her $787 if she paid money. The worth for paying with insurance coverage wouldn’t be out there for one more week or two, she was advised.

But even the money worth didn’t change into proper: Just a few weeks after the go to, the hospital billed her a further $2,260.

It seems that the unique estimate disregarded a drug her son would want.

“It was essentially the most convoluted, ineffective course of,” stated Ms. Eichelberger, who was capable of get the invoice waived after 5 months of negotiations with the hospital.

Daron Cowley, a spokesman for Layton’s well being system, Intermountain, stated Ms. Eichelberger obtained the extra invoice as a result of “a new employee provided incomplete information with a price estimate that was not accurate.”

The well being system declined to touch upon costs at its hospitals, saying its contracts with insurers forbid discussing negotiations.

It’s not clear how significantly better the Eichelbergers would do at present.

The new worth information is commonly printed in hard-to-use codecs designed for information scientists {and professional} researchers. Many are bigger than the total textual content of the Encyclopaedia Britannica.

And most hospitals haven’t posted all of it. The potential penalty from the federal authorities is minimal, with a most of $109,500 per yr. Big hospitals make tens of hundreds of instances as a lot as that; N.Y.U. Langone, a system of 5 inpatient hospitals that haven’t complied, reported $5 billion in income in 2019, in line with its tax types.

As of July, the Centers for Medicare and Medicaid Services had despatched almost 170 warning letters to noncompliant hospitals however had not but levied any fines.

Catherine Howden, a spokeswoman for the company, stated it anticipated “hospitals to comply with these legal requirements, and will enforce these rules.”

She added that hospitals that don’t publish costs inside 90 days of a warning letter “may be sent a second warning letter.”

The company plans to extend the fines subsequent yr to as a lot as $2 million yearly for giant hospitals, it introduced in July.

The hospital that handled Ms. Eichelberger’s son has begun posting some data. But it has unfold its costs throughout 269 net pages. To search for rabies, you must examine all of them. It isn’t there.

Six months after the brand new guidelines took impact, The Times reached out to the ten highest-revenue hospitals that had posted little or no information about their negotiated charges or money costs. Here’s what they needed to say:

“We will not be providing a statement or comment.”

N.Y.U. Langone has not printed its negotiated charges or money costs.

“Services that do not have a fixed payer-specific rate are shown as variable.”

Stanford Health Care has not printed its money costs. Of greater than 300,000 potential combos of insurance coverage and medical remedy in its information file, it consists of costs for 479.

“We do not post standard cash rates, which typically will not reflect the price of care for uninsured patients.”

Cedars-Sinai Medical Center, in Los Angeles, has not printed its money costs. The hospital initially posted a 2.5 GB information file composed nearly totally of multiple million strains that contained no information. After The Times inquired concerning the giant file measurement, the hospital diminished it to a 1.4 MB file.

“We have listed the fixed rates where possible and, where that is not possible, have listed them as ‘variable.’”

U.C.S.F. Medical Center has not printed its money costs. Of greater than eight million potential combos of insurance coverage and medical remedy in its information file, U.C.S.F. consists of negotiated charges for 346. (U.C. Davis, which is a part of the identical system and has additionally not printed its money costs, despatched an similar assertion.)

“The resources we provide ensure that our patients know what kind of assistance is available to them and, ultimately, what a procedure will cost them ・not us.”

Montefiore Medical Center, within the Bronx, has not printed its negotiated charges or money costs.

“Penn Medicine is committed to transparency about potential costs.”

The Hospital of the University of Pennsylvania added money costs to its worth transparency file after The Times inquired about why that information was lacking.

“V.U.M.C. offers a toll-free number which consumers can call if they have questions about what they may be charged for services.”

Vanderbilt University Medical Center, in Nashville, has not printed its negotiated charges or money costs.

“Orlando Health has worked hard over the past several years to deliver helpful pricing information to its patients.”

Orlando Health has not printed its negotiated charges or money costs.

Methodist Hospital (San Antonio) didn’t reply to a number of requests for remark. The hospital has not printed its negotiated charges or money costs.

“We are continuing to work on the machine-readable file that includes payer-negotiated rates. … It involves analyzing a daunting number of data points.”

Long Island Jewish Medical Center has not printed its negotiated charges or money costs.

The largest hospitals had been chosen primarily based on gross income reported to the Centers for Medicare and Medicaid Services in 2018, the newest yr with full information out there.